The Grand Rapids Public Schools just shared these P-EBT updates and information.

The Grand Rapids Public Schools just shared these P-EBT updates and information.

Pandemic Electronic Benefit Transfer Program (P-EBT) food assistance benefits will go to Michigan families with students ages 0-26 that are eligible for Free or Reduced-Price School Meals. This includes families currently receiving Food Assistance Program (FAP) benefits, as well as those not currently enrolled in the program. No application is necessary for eligible families to receive P-EBT benefits.

Program Information

Q: When will P-EBT cards be mailed out?

A: P-EBT benefits are being distributed in waves. The first round of benefits for families with active Food Assistance Program cards started last week and will continue to be distributed through the first week of May. The benefit will go to their bridge card. Families that do not have a bridge card will be mailed a P-EBT card. These cards will also be distributed in waves. The first cards start mailing out April 26th and will continue through the middle of May. Instructions are being mailed out for how to use and activate the card.

Again, it will take until the middle of May for cards to be mailed out. Please encourage families to hold off on calling DHHS with inquiries and wait for the first round of mailing to go out.

Q: Will there be directions on how to use the card?

A: There will directions mailed about a week ahead of the card. To activate the card, call the phone number on the back of the card. You will need the EBT card number on the front of the card, your zip code, and the date of birth of the oldest child in your household. You will need to set a four-digit pin number

Q: What address will the P-EBT card be sent to?

A: If the student was already receiving SNAP benefits, they will automatically receive the P-EBT benefits on their current Food Assistance Program (FAP) card. If the student is eligible based on a Free or Reduced-Price Meal Application, a new P-EBT card will go to the address in the Michigan Student Data System.

Q: Will there be an email or phone number available for parent questions regarding the P-EBT cards?

A: MDHHS is processing cards in batches thru mid-May. If you receive calls on P-EBT cards you may supply them with this number 1-833-905-0028. Keep in mind they might not answer the questions until then.

P-EBT Student Eligibility

Q: I have multiple school-age children, how much will our family be eligible for?

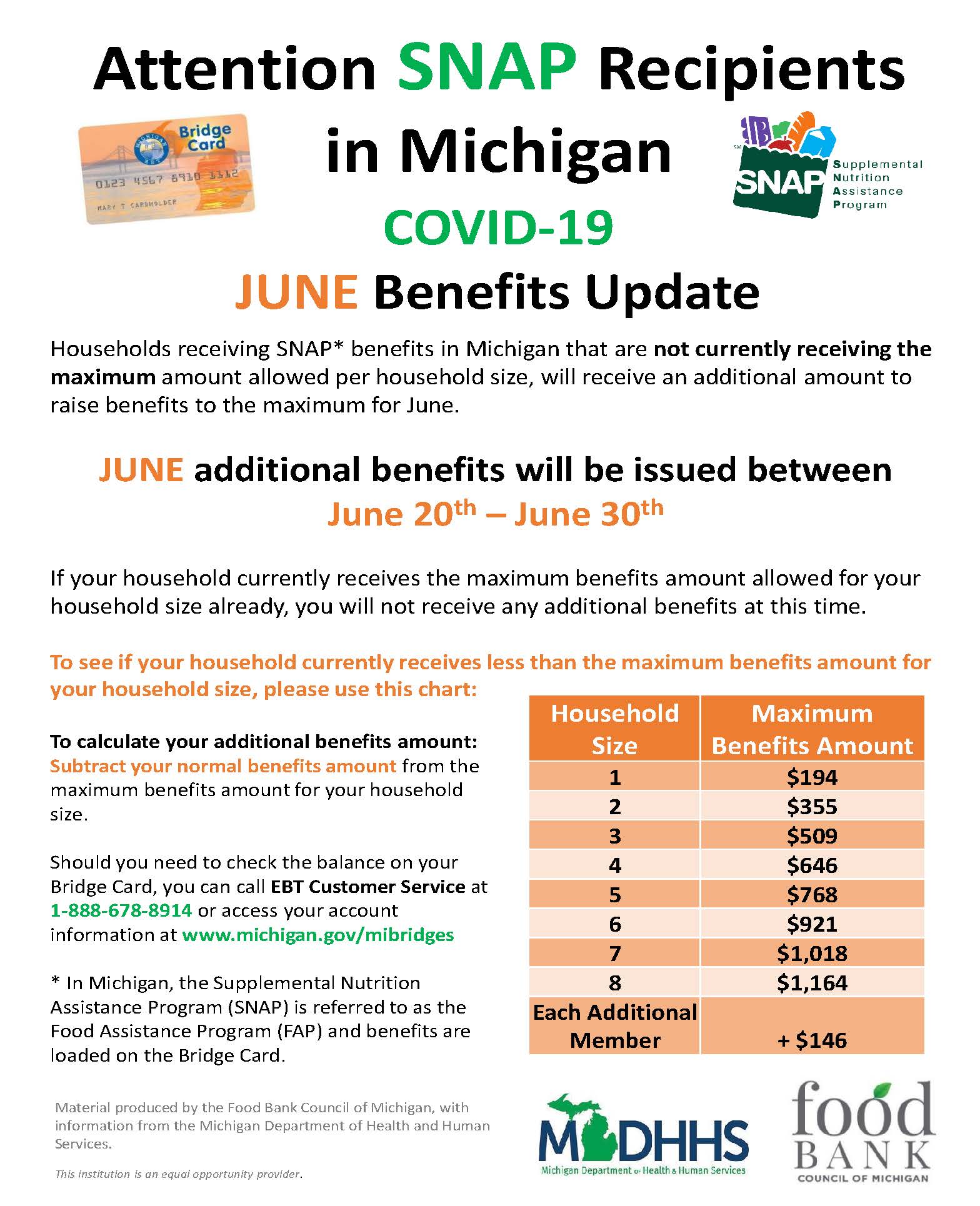

A: The pre-loaded Pandemic-EBT card will come in the mail and will be in the oldest school aged child’s name, not the parents name. Keep the card for ongoing benefits you may receive. The benefit amount for March/April is $193.80 per child and will be available by the end of April. The benefit amount for May/June is $182.40 per child and will be available by the end of May.

Q: For students that attend a CEP school, will all families be eligible for the P-EBT program automatically

A: In schools where all students receive free lunch and breakfast, which in Michigan is the Community Eligibility Provision (CEP), all students will automatically receive the P-EBT benefits.

Q: Do schools need to send anything over to the Michigan Department of Education?

A: For non-CEP schools, eligibility for P-EBT was based on data reported in the Supplemental Nutrition Eligibility (SNE) field in the Michigan Student Data System (MSDS) Spring Collection.

Updated addresses or student eligibility will need to be submitted through the Student Record Maintenance in the MSDS. Records that are submitted by the April 28th SRM will be eligible for April, May and June P-EBT benefits. Records that are submitted for the May 12th and 26th SRM will be eligible for May and June P-EBT benefits.

Q: Are Head Start and/or Great Start Readiness Program (GSRP) families receiving the P-EBT card?

A: Students in Great Start Readiness Programs, GSRP/Headstart Blends, Early Headstart, and Headstart that were reported as part of the Early Childhood Collection as eligible for Free and Reduced-Price Meals or directly certified have been included.

Q: Are students who attend non-public schools eligible for P-EBT?

A: Directly certified students who attend non-public schools were included in the list of students eligible for P- EBT. If the student was already receiving SNAP benefits, they will automatically receive the P-EBT benefits on their card. For other directly certified students without an address with DHHS or the Michigan Student Data System (MSDS), the card will be sent to the school and the school must mail the cards to the families.

If a student was a shared time student with a public school and that school reported the student in the Michigan Student Data System (MSDS) as eligible for Free and Reduced-Price Meals, they will receive the benefit through the public school’s reporting.

There is not a state collection where F/R application eligible students are reported, but we are working on ways to try and include them at a later date.

Q: Are 18-26 special education students eligible for P-EBT?

A: Eligible, enrolled special education students are eligible for P-EBT.

Q: Do children that are homeschooled qualify for this program?

A: Unfortunately, homeschool children were not included in the list for P-EBT because they are not in the public school records. However, all Michigan children are eligible to participate in one of available Meet Up Eat Up sites. You can look for the closest site to your home at: www.michigan.gov/meetupeatup or Dial 211 to find out more information on resources in your local community.

New Free and Reduced Applications

Q: Will newly eligible students, through Direct Certification or an approved Free or Reduced-Price application, be eligible for P-EBT.

A: Yes, students with new eligibility will qualify for P-EBT. Updated student eligibility will need to be submitted through the Student Record Maintenance (SRM) in the Michigan Student Data System (MSDS). Records that are submitted by the April 28th SRM will be eligible for April, May and June P-EBT benefits. Records that are submitted for the May 12th and 26th SRM will be eligible for May and June P-EBT benefit.

Q: For families with multiple children, how will the card be loaded?

A: The pre-loaded P-EBT card will come in the mail and will be in the oldest school aged child’s name, not the parents name.

Q: What do GRPS families do if they did not receive a communication in the mail from the state about P-EBT benefits?

A: Families should be referred to Steve Slabbekoorns in Nutrition Services. He is available at 819-2135 or email at slabbekoorns@grps.org. Nutrition Services will work with Student Data Systems to submit updated data to the state system.

Pandemic Electronic Benefit Transfer Program (P-EBT) Frequently Asked Questions (Spanish)

Pandemic Electronic Benefit Transfer Program (P-EBT) Frequently Asked Questions (Kinyarwanda)

Pandemic Electronic Benefit Transfer Program (P-EBT) Frequently Asked Questions (Swahili)

The Grand Rapids Public Schools just shared these P-EBT updates and information.

The Grand Rapids Public Schools just shared these P-EBT updates and information.